We combine over thirty years of working with businesses in numerous industries at various stages of development with the unique value of delivering a private equity value proposition to owners and operators without dilution. Our founder, Paul Cascio, started his career in investment banking in 1983 and then spent 13 years as a Partner with a middle-market private equity firm. He has worked on each end of the spectrum of organizational development—collaborating with management teams to build sustainable value creation.

Given the depth of our experience, we understand your needs and the challenges you face. 3S Advisors will help to identify all that needs to be done to make a good company a great company. We work with you to both develop and execute the growth plan. We know the fundamental building blocks for a solid foundation on which to build a business.

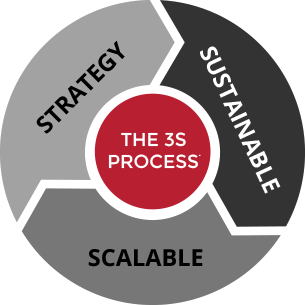

A well thought out STRATEGY helps to prevent an opportunistic approach to growth. The business model, capital structure and management team need to be SCALABLE if growth is to be achieved. The company needs to be SUSTAINABLE to withstand competitive pressures and market volatility.

Orchestrating and negotiating every type of transaction and complex financial transaction is second nature to us. We can advise your company in every aspect of capital markets transaction, including mergers, acquisitions, joint ventures, and roll-ups, equity, debt financings and recapitalizations.

From the outset of our engagement, we immerse ourselves in your business and begin to learn your story, your goals, your strengths—and your greatest areas of opportunity. Our objective and honest advice is grounded in practical and tangible experience allowing us to develop and implement a comprehensive strategic growth plan to optimize value creation of your company.

Fostering a collaborative, transparent, and ethical “win together” mindset, we provide peace of mind—you have a trusted advisor to talk with about the achievement of your short and long-term business goals.